1. Our opinion is unmodified

We have audited the financial statements of Halfords Group plc for the year ended 30 March 2018 which comprise the Consolidated Income Statement, Consolidated Statement of Comprehensive Income, Consolidated Statement of Financial Position, Company Balance Sheet, Consolidated Statement of Cash Flows, Consolidated and Company Statements of Changes in Shareholders' Equity, and the related Notes to the Financial Statements, including the Accounting Policies.

In our opinion:

- the financial statements give a true and fair view of the state of the Group's and of the parent Company's affairs as at 30 March 2018 and of the Group's profit for the year then ended;

- the Group financial statements have been properly prepared in accordance with International Financial Reporting Standards as adopted by the European Union (IFRSs as adopted by the EU);

- the parent Company financial statements have been properly prepared in accordance with UK Accounting Standards, including FRS 101 Reduced Disclosure Framework; and

- the financial statements have been prepared in accordance with the requirements of the Companies Act 2006 and, as regards the Group financial statements, Article 4 of the IAS Regulation.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (UK) ("ISAs (UK)") and applicable law. Our responsibilities are described below. We believe that the audit evidence we have obtained is a sufficient and appropriate basis for our opinion. Our audit opinion is consistent with our report to the audit committee.

We were appointed as auditor by the shareholders on 29 July 2009. The period of total uninterrupted engagement is for the 9 financial years ended 30 March 2018. We have fulfilled our ethical responsibilities under, and we remain independent of the Group in accordance with, UK ethical requirements including the FRC Ethical Standard as applied to listed public interest entities. No non-audit services prohibited by that standard were provided.

| Overview | | |

| Materiality: group financial statements as a whole | £3.2m (2017: £3.3m)

4.7% (2017: 4.7%) of normalised profit

before tax |

| Coverage | 100% (2017:100%) of group profit before tax |

| Risks of material misstatement | vs 2017 |

| Recurring risks | Carrying amount of Autocentres Goodwill | ↔ |

| Carrying value of Retail division inventory | ↔ |

| Parent company | Recoverability of parent company's debtor balance | ↔ |

2. Key audit matters: our assessment of risks of material misstatement

Key audit matters are those matters that, in our professional judgment, were of most significance in the audit of the financial statements and include the most significant assessed risks of material misstatement (whether or not due to fraud) identified by us, including those which had the greatest effect on: the overall audit strategy; the allocation of resources in the audit; and directing the efforts of the engagement team. We summarize below the key audit matters, in decreasing order of audit significance, in arriving at our audit opinion above, together with our key audit procedures to address those matters and, as required for public interest entities, our results from those procedures. These matters were addressed, and our results are based on procedures undertaken, in the context of, and solely for the purpose of, our audit of the financial statements as a whole, and in forming our opinion thereon, and consequently are incidental to that opinion, and we do not provide a separate opinion on these matters.

| The risk | Our response |

Carrying amount of Autocentres (Car Servicing) Goodwill (£69.7 million; FY17: £69.7 million) Refer to Audit Committee Report, accounting policy and financial disclosures

. | Forecast-based estimate Following the acquisition of Nationwide Autocentres in 2010, the Group holds significant goodwill in the Autocentres division. The business operates in a competitive market, and commercial factors, changes to market share or changes to the frequency with which customers replace their cars, may lead to a risk that the business does not meet the growth projections. The estimated recoverable amount is subjective due to the inherent uncertainty involved in forecasting these cash flows and therefore, this is considered to be one of the key judgemental areas that our audit is concentrated on. | Our procedures included: - Benchmarking assumptions: Comparing the Group's assumptions, in particular those relating to forecast long term growth rates and discount rates, to externally derived data and budgeted growth rate to industry forecasts and assessing the historical forecasting accuracy;

- Historical comparisons: Assessing the Group's performance against budget in the current and prior periods to evaluate the historical accuracy of the Group's forecasts;

- Sensitivity analysis: Performing sensitivity analysis on the assumptions, including budgeted growth rates, discount rate and terminal growth rate;

- Comparing valuations: Comparing the sum of the discounted cash flows to the Group's market capitalisation to assess the reasonableness of those cash flows; and

- Assessing transparency: Assessing whether the group's disclosures about the sensitivity of the outcome of the impairment assessment to changes in key assumptions reflected the risks inherent in the valuation of goodwill.

Our result We have found the carrying amount of Autocentres (Car Servicing) goodwill to be acceptable. |

Carrying value of Retail division inventory £186.8 million; FY17: £181.4 million) Refer to Audit Committee Report, accounting policy and financial disclosures. | Subjective estimate: Inventories are carried at the lower of cost and net realisable value. The estimated net realisable value of inventory and associated provisions are subjective due to the inherent uncertainty in predicting consumer demand. The obsolete stock provision is based on a model which includes consideration of each inventory line, recent sales of those lines and the product's position in its lifecycle. The Group further overlays specific provisions to account for other matters not captured in the model, such as known stock losses and faulty goods. There is a risk that the Group's assessment of the level of these provisions is insufficient or inaccurate. | Our procedures included: - Assessing methodology: Assessing the adequacy of the Group's inventory provision methodology based on our knowledge of the industry and factors specific to the Group;

- Assessing assumptions: Assessing and challenging the directors assumptions behind the changes to the provision methodology against our own knowledge of the industry and factors specific to the Group;

- Tests of detail: Testing the key inputs to the provisioning model, including recent sales data and inventory costing;

- Historical comparisons: Assessing the accuracy of inventory provisioning by checking the historical accuracy of the level of inventory provisions in prior periods; and

- Assessing transparency: Assessing the adequacy of the Group's disclosures about the degree of estimation involved in arriving at the provision.

Our result As a result, we consider the carrying value of retail division inventory to be acceptable. |

Recoverability of parent's debt due from group entities (£485.8 million; FY17: £478.5 million) Refer to financial disclosures. | Low risk, high value

The carrying amount of the group undertakings represents 95% of the parent company's total assets. Their recoverability is not at a high risk of significant misstatement or subject to significant judgement. However, due to their materiality in the context of the parent company financial statements, this is considered to be the area that had the greatest effect on our overall parent company audit. | Our procedures included: - Tests of detail: Assessing 100% of group debtors balance to identify, with reference to the relevant debtors net assets, both individually and collectively with their own subsidiaries where relevant, to consider whether they have a positive net asset value and therefore coverage of the debt owed. We considered the results of our audit work over those net assets.

Our result We found the group's assessment of the recoverability of the group debtor balance to be acceptable. |

3. Our application of materiality and an overview of the scope of our audit

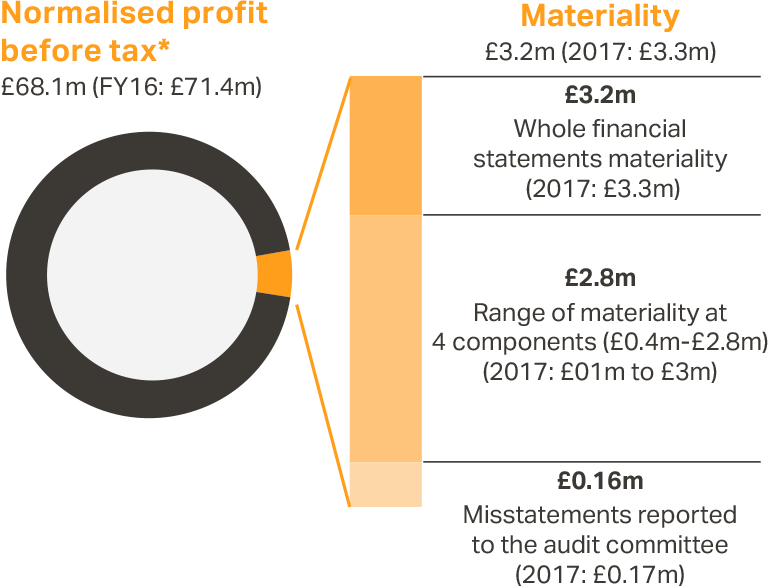

Materiality for the group financial statements as a whole was set at £3.2 million (FY17: £3.3 million), determined with reference to a benchmark of group profit before tax normalised to exclude one off Directors' remuneration (see note 5), of £68.1 million, of which it represents 4.7% (FY17: with reference to a benchmark of group profit before tax, of which it represented 4.7%).

Materiality for the parent company financial statements as a whole was set at £2.8 million (FY17: £ 3.0 million), determined with reference to a benchmark of total assets, of which it represents 0.6% (FY17: 0.6%).

We reported to the Audit Committee any corrected or uncorrected identified misstatements exceeding £0.16 million (FY17: £0.17 million), in addition to other identified misstatements that warranted reporting on qualitative grounds.

Of the Group's 4 (FY17: 5) components, we subjected 4 (FY17: 5) to full scope audits for group purposes. Cycle Republic was split out as a separate component in FY17 but this year has been included within Halfords Retail. All components are located in the UK.

The components within the scope of our work accounted for the percentages illustrated opposite.

The group team approved the component materialities, which ranged from £0.5 million to £2.9 million (FY17: £0.1 million to £3.0 million), having regard to the mix of size and risk profile of the Group across the components. The work, including the audit of the parent Company, was performed by the group team. The group team also performed procedures on the items excluded from normalised group profit before tax.

4. We have nothing to report on going concern

We are required to report to you if:

- we have anything material to add or draw attention to in relation to the directors' statement to the financial statements on the use of the going concern basis of accounting with no material uncertainties that may cast significant doubt over the Group and Company's use of that basis for a period of at least twelve months from the date of approval of the financial statements; or

- the related statement under Listing Rules set out in the Corporate Governance Report is materially inconsistent with our audit knowledge

We have nothing to report in these respects.

Group materiality

Profit before tax

* FY18 profit before tax was normalised to exclude one off Directors' remuneration (see note 5)

Group revenue

FY2017 100%

FY2018 100%

Group profit before tax

FY2017 100%

FY2018 100%

5. We have nothing to report on the other information in the Annual Report

The directors are responsible for the other information presented in the Annual Report together with the financial statements. Our opinion on the financial statements does not cover the other information and, accordingly, we do not express an audit opinion or, except as explicitly stated below, any form of assurance conclusion thereon.

Our responsibility is to read the other information and, in doing so, consider whether, based on our financial statements audit work, the information therein is materially misstated or inconsistent with the financial statements or our audit knowledge. Based solely on that work we have not identified material misstatements in the other information.

Strategic report and directors' report

Based solely on our work on the other information:

- we have not identified material misstatements in the strategic report and the directors' report;

- in our opinion the information given in those reports for the financial year is consistent with the financial statements; and

- in our opinion those reports have been prepared in accordance with the Companies Act 2006.

Directors' remuneration report

In our opinion the part of the Directors' Remuneration Report to be audited has been properly prepared in accordance with the Companies Act 2006.

Disclosures of principal risks and longer-term viability

Based on the knowledge we acquired during our financial statements audit, we have nothing material to add or draw attention to in relation to:

- the directors' confirmation within the viability statement in the Directors' Report that they have carried out a robust assessment of the principal risks facing the Group, including those that would threaten its business model, future performance, solvency and liquidity;

- the disclosures describing these risks and explaining how they are being managed and mitigated; and

- the directors' explanation in the viability statement of how they have assessed the prospects of the Group, over what period they have done so and why they considered that period to be appropriate, and their statement as to whether they have a reasonable expectation that the Group will be able to continue in operation and meet its liabilities as they fall due over the period of their assessment, including any related disclosures drawing attention to any necessary qualifications or assumptions.

Under the Listing Rules we are required to review the viability statement. We have nothing to report in this respect.

Corporate governance disclosures

We are required to report to you if:

- we have identified material inconsistencies between the knowledge we acquired during our financial statements audit and the directors' statement that they consider that the annual report and financial statements taken as a whole is fair, balanced and understandable and provides the information necessary for shareholders to assess the Group's position and performance, business model and strategy; or

- the section of the annual report describing the work of the Audit Committee does not appropriately address matters communicated by us to the Audit Committee.

We are required to report to you if the Corporate Governance Statement does not properly disclose a departure from the eleven provisions of the UK Corporate Governance Code specified by the Listing Rules for our review.

We have nothing to report in these respects.

6. We have nothing to report on the other matters on which we are required to report by exception

Under the Companies Act 2006, we are required to report to you if, in our opinion:

- adequate accounting records have not been kept by the parent Company, or returns adequate for our audit have not been received from branches not visited by us; or

- the parent Company financial statements and the part of the Directors' Remuneration Report to be audited are not in agreement with the accounting records and returns; or

- certain disclosures of directors' remuneration specified by law are not made; or

- we have not received all the information and explanations we require for our audit.

We have nothing to report in these respects.

7. Respective responsibilities

Directors' responsibilities

As explained more fully in their statement set out in the Directors' Responsibilities section, the directors are responsible for: the preparation of the financial statements including being satisfied that they give a true and fair view; such internal control as they determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error; assessing the Group and parent Company's ability to continue as a going concern, disclosing, as applicable, matters related to going concern; and using the going concern basis of accounting unless they either intend to liquidate the Group or the parent Company or to cease operations, or have no realistic alternative but to do so.

Auditor's responsibilities

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or other irregularities (see below), or error, and to issue our opinion in an auditor's report. Reasonable assurance is a high level of assurance, but does not guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise from fraud, other irregularities or error and are considered material if, individually or in aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements.

A fuller description of our responsibilities is provided on the FRC's website at www.frc.org.uk/auditorsresponsibilities.

Irregularities – ability to detect

We identified areas of laws and regulations that could reasonably be expected to have a material effect on the financial statements from our sector experience through discussion with the directors and other management (as required by auditing standards).

We had regard to laws and regulations in areas that directly affect the financial statements including financial reporting (including related company legislation) and taxation legislation. We considered the extent of compliance with those laws and regulations as part of our procedures on the related financial statement items.

We communicated identified laws and regulations throughout our team and remained alert to any indications of non-compliance throughout the audit.

As with any audit, there remained a higher risk of non-detection of non-compliance with relevant laws and regulations, irregularities, as these may involve collusion, forgery, intentional omissions, misrepresentations, or the override of internal controls.

8. The purpose of our audit work and to whom we owe our responsibilities

This report is made solely to the Company's members, as a body, in accordance with Chapter 3 of Part 16 of the Companies Act 2006. Our audit work has been undertaken so that we might state to the Company's members those matters we are required to state to them in an auditor's report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the Company and the Company's members, as a body, for our audit work, for this report, or for the opinions we have formed.

Michael Froom (Senior Statutory Auditor)

for and on behalf of KPMG LLP, Statutory Auditor

Chartered Accountants

One Snowhill

Snow Hill Queensway Birmingham

B4 6GH

22 May 2018