Shareholder KPIs

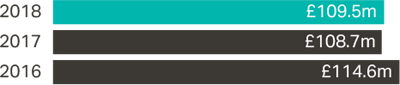

Underlying profit before tax

The Board considers that this measurement of profitability provides stakeholders with information on trends and performance, before the effect of non-recurring items.

Underlying profit before tax declined by 5.0% year-on-year, primarily due to the impact of the weaker pound on the cost of imported goods.

Underlying earnings per share

EPS is a measure of our investment thesis and as such we aim to manage revenues, margins and invest in long term growth.

Underlying earnings per share declined by 2.3% year-on-year. See above for explanation.

Underlying EBIT & Underlying EBITDA

Underlying EBIT is results from operating activities before non-recurring items. Underlying EBITDA further removes Depreciation and Amortisation.

The Board considers that these measurements of profitability are a viable alternative to underlying profit and uses these measures to incentivise Management.

Underlying EBIT declined by 3.2% year-on-year. See above for explanation. Underlying EBITDA increased by 0.7% year-on-year. The reason for the improved EBITDA result compared to PBT and EPS is because it is before an additional year-on-year £1.3m of interest costs and £3.3m of depreciation and amortisation.

The above numbers represent Underlying EBITDA

Dividend per Ordinary Share

Cash returned to shareholders as a return on their investment in the Company.

Our prevailing policy is to grow the dividend every year with cover of around 2x underlying earnings on average over time. The impact of adverse FX movements will reduce cover temporarily until fully mitigated, which will take some time.

The Board has recommended a final ordinary dividend of 12.03 pence per share (FY17: 11.68 pence), which if approved would take the full-year ordinary dividend to 18.03 pence per share, an increase of 3.0% on the prior year.

Nebt Debt

The Group remains strongly cash generative and continues to invest in the business. The Board is committed to maintaining an efficient balance sheet, returning any surplus capital not required to fund growth to shareholders. This measure helps to understand the financing structure of the Group.

Net Debt has remained broadly flat on FY17 levels, despite planned follow-on M&A payments and the working capital impact of VAT payment timing.

Net Debt to Underlying EBITDA ratio

Represented by the ratio of Net Debt to Underlying EBITDA, both of which are defined above.

We currently continue to target a ratio of 1.0x, with a range of up to 1.5x to allow for appropriate M&A. We will arrive at the debt target over time. This ratio helps to compare the financial result for the year to debt levels.

The Group had a Net debt to underlying EBITDA ratio of 0.8 times at the end of FY18.

Like for like sales

Revenues from stores, Autocentres and websites that have been trading for at least a year (but excluding prior year sales of stores and Autocentres closed during the year) at constant foreign exchange rates.

Like for like sales is a widely used indicator of a retailer's trading performance, and is a comparable measure of our year-on-year sales performance.

A balanced result across both Retail and Autocentres.

| FY18 LFL revenue movement |

|---|

| Halfords Group | +2.0% |

| Retail | +2.3% |

| Motoring | +1.9% |

| Car Maintenance | +3.7% |

| Car Enhancement | -2.2% |

| Travel Solutions | +3.6% |

| Cycling | +2.9% |

| Autocentres | +0.2% |

Operational KPIs

Proportion of trained Retail colleagues

Measures the progress of our colleagues through the 3-Gears training programme.

We aim to have the majority of our colleagues trained to Gear 2 plus around two colleagues per store trained to the Gear 3 "guru" level.

By the end of the year over 70% of our eligible Retail store colleagues were qualified at Gear 2 level.

The above numbers represent the proportion of colleagues qualified at Gear 2 level

Service-related Retail sales growth

Service-related Retail sales is the income derived from the fitting or repair services themselves along with the associated product sold within the same transaction.

To grow service-related Retail sales faster than total Retail sales growth.

Service-related Retail sales grew by 14% in the year. We also added new services, taking the total in-store offering to over 70 services across motoring and cycling.

Proportion of Retail transactions matched to a customer

The proportion of transactions in Halfords Retail that can be matched to a specific customer in our database.

To increase our understanding of who our customers are. We will do this by adding to our customer databases and combing them to create a single customer view.

We can match 59% of Retail transactions to customers, up from 46% at the end of last year. Understanding our customers even better means that we can continue to become more relevant to them.

Cycle Republic stores (cumulative)

The proportion of transactions in Halfords Retail that can be matched to a specific customer in our database.

We do not have a fixed store rollout target.

We opened 4 stores in FY18, in Reading, Derby, Cheltenham and Canary Wharf, with Glasgow following shortly after the year end. This takes the total to 20 stores as of May 2018.

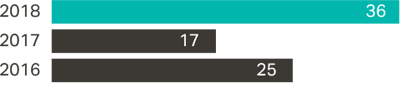

Store and Autocentre refreshes

The number of Retail stores and Autocentres refreshed in the year.

We are committed to refreshing the design of our physical portfolio in order to improve the customer experience.

During the year we refreshed 36 Retail stores and 6 Autocentres in the latest format.

The above numbers represent the number of Retail stores refreshed

Online sales as a proportion of total Retail sales

Online sales as a proportion of total Retail sales.

We are committed to improving our online shopping experience for customers.

Our online sales represented around 16% of total Retail sales.